Looking for a RV – or to replace one?

Well, truth be told, my fifth wheel is for sale, but that is a subject for a different post. My goal in this post is to update you on my summer 2017 experience and on trends I’m seeing in the RV industry over the past several months. As you may know, I’m a full time traveler. I’ve chosen however to spend the past 3 summers in Casper, Wyoming at a RV dealer, consulting and selling rv’s – along with exploring the amazing state of Wyoming!

I have a quick video below where I want to reconnect with you and then some additional insights in writing below the video…

Important & Current Trends in the RV World

As noted in my video, the banks are tightening. The FED (Federal Reserve) has raised the prime rate 50 basis points this year and the banks have responded by raising interest rates on recreational loans – and more. The best rates now for borrowers who want a long term (12+ years) and have 800 credit are around or just over 6%.

Remember, a RV is a recreational loan (you don’t REALLY have to have one!) As such, rates are higher, banks hold the borrower to a higher standard to qualify (you need a high credit score and a clean profile), but the interest CAN be written off since a RV (at least most) are “self-contained”. For more on RV Loans, click HERE.

When it comes to bank financing, what does “and more” really mean?

I’m not only seeing bank rates rise, I’m seeing the banks get more picky on whom they will lend to. Yep, some folks with really good credit are getting rejected! One of our primary lenders recently pulled their “roll-em” (automatic approval) program – which will heavily impact self-employed people who reinvest profits back into their businesses rather than paying themselves a salary.

Key things to avoid when it comes to your credit:

- Avoid late pays – even a few days late on your credit card bill can create a “strike” that will give your lender an excuse to raise the rate they offer you – or reject you outright.

- Don’t get into “pissing matches” with your cell phone company or cable company over relatively small amounts, only to stand on principle and have the cell or cable company refer your $300. unpaid bill to a collection agency. This WILL damage your credit AND will cost you far more than the few hundred dollars you’re disputing with them!

- THINK before you borrow! Do you really NEED the item you’re about to borrow money to acquire? Now, if its a RV, yes, we can probably agree that most don’t NEED one, but you may decide its worth having one – especially if it helps you with your business or if you have a young family and want the opportunity to spend quality time with the kids – who are after all, only young once!

- USE credit to HAVE credit – that is to say, if you don’t have any loans or ever use credit cards, you won’t have a strong credit score which IS needed to get financing when buying a RV

Just yesterday I had to turn away 3 buyers who wanted RV’s this week, two could not get financed at all due to their credit score and profile and one received an offer from a lender for a short term at a very high interest rate causing his monthly payment to be well above what he could tolerate. Needless to say, he passed on the offer – and the trailer he wanted remains on our sales lot.

Why are the banks tightening now?

This is PURELY my thoughts and conjecture, but I’m not optimistic about our national economy as we move further into 2017 and 2018. I certainly can’t pinpoint WHEN something bad will happen, but I see warning signs all over the place. I’m not trying to sound like a doomsday-er but, I believe at some point a recession (or far worse) will occur and the banks are seeing this as well – hence the tightening we’re seeing now with recreational loans.

I think you and I need to be realistic about how much debt we take on at this time, I’m not saying its time to roll up the carpet and hibernate in your bomb shelter, but act with forethought and caution. Taking on debt CAN make sense depending upon your circumstances.

**I welcome your input on any of these topics I’m touching upon. Please use the reply space below.**

RV’s have many practical advantages – a 30,000 ft. overview:

Taking on some debt to have a RV as I’ve noted above may make sense in some scenarios. Consider these few –

- You’re in a job or profession where traveling and living out of your RV will save you money and provide you with convenience (consider a toy hauler with room for tools and more). You may even receive a “per diem” in your job that covers all campground expenses (and more) – all the while having the advantage of sleeping in your OWN BED and having your own refrigerator filled with HEALTHY food instead of eating at roadside truck stops. (And if you use your trailer for business, there may be other tax advantages.)

- You’re traveling with the family and wish to save money by staying in your own RV instead of paying motel fees. I was working with a client recently who shared he paid $2200. for a weeks lodging in Jackson, Wyoming (and who knows how much on eating out?!) If they had a RV, a weeks stay near Jackson can be had for about $250. Consider the savings!

- Personally as a full time RV’er, I find traveling by RV less stressful than traveling by motel. You always know where you’re sleeping and can eat better, and you pull over when and where you’re ready to call it a night with far more options than when traveling by motel.

But… Is a RV even right for you?

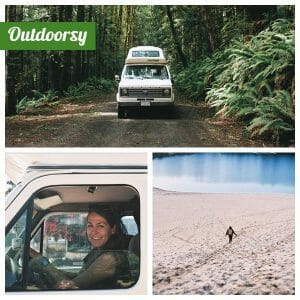

Recently, I partnered with a company called Outdoorsy – they provide a valuable service for those who are deciding whether or not to buy a RV – or for someone who simply needs a RV only on occasion. They help those who wish to RENT A RV find owners of RV’s (mostly private owners from across the nation) who will rent out their RV’s. Outdoorsy does (of course) charge a service fee, but they also provide insurance to BOTH the renter and the RV owner and assist the renter if they get in trouble with their rented RV while they’re out in the field. If a service like this makes sense to you and you wish to try it out, click the banner below to save $50. in fees on your first rental through Outdoorsy, and if you’re an owner, you can click the banner below to register your RV. I will do a thorough review of their service in the near future.

RV Buying Trends – Summer 2017

Business (nationwide) is up – way up. Travel trailer sales are up over 20%, fifth wheel sales over 5%, and I suspect motorhome sales are way up as well. Part of this is demographics – boomers who are retiring and looking to travel. Part is lower fuel prices, and part is for other reasons – such as families moving into RV’s as campground rental costs (on a monthly basis) are far less than apartment/home rentals in many markets.

Here in Wyoming, I’m seeing similar – buyers are looking for travel trailers (especially smaller trailers), motorhomes – especially Class C or Class A “diesel pushers.” There is also a great demand for used RV’s. RV’s are not like trucks or cars – people often sell used RV’s after years of very little use.

**If you DO buy a RV… don’t pass on getting an extended service contract – see HERE for why.**

Did you know??

Recently, I did a study of used trailer values with an idea of identifying the rate at which they depreciate. I discovered (not surprisingly) the rate of depreciation is greatest for the first 2 years of a RV’s life. After the first 2 years, the RV continues to depreciate BUT at a much slower rate. One may conclude that unless there is a good reason to buy new, buying a 3 – about 6 year old RV is your best investment in the fun and lifestyle of RV’ing without experiencing the initial depreciation.

In my case, I opted for new (a 2018 Glacier Peak F30RLS) for a couple of reasons – a) no hidden issues and b) this model did not exist before 2017. For those who are curious as to why I opted for a Glacier Peak fifth wheel, read more HERE.

Wrapup

The summer of 2017 is racing along. I can’t believe July is nearly over (as I write this). Here in Wyoming, in about 2-3 weeks the first “taste” of Autumn typically arrives, and certainly by Labor Day, its VERY clear the seasons are changing. In the past two summers, it was the day after Labor Day where I hit the road and resumed my travelin’ journey. This year, I plan to remain in Casper for about 4 additional weeks as I wait for the arrival of my Glacier Peak. I will then have a shortened travel season before I settle into McCall Idaho for the winter – during which most days you’ll find me on the ski slopes!

Recommended Continued Reading

My highly acclaimed 5 part series on how to buy a RV

Why I would never be caught without an Extended Service Contract for my RV

Exploring the Flaming Gorge & Lucerne Campground

Thinking of buying an RV to travel / live in for a summer, and to ski out west for a winter, then live in the following summer (total 18 months?) Have no idea what I’m doing, but was looking at Arctic Fox brand trailer type for its winter capability, and smaller size and weight than a larger 5th wheel style. What are your thoughts?

Thx.

ken

Ken,

Thanks for reaching out. Arctic Fox (AF) would be a solid choice. Also – the trailer I’m in – Outdoors RV – would work as well. I’d have a look at the AF 29-5 (two models), 32-5, and Glacier Peak 30 (2 models). I’d recommend used – especially since you plan to stay in it only for 1.5 years. I do have a concierge buying service, let me know if that would be of interest (rvAcrossAmerica.net/buysell). If you buy used at the right price, you’ll be able to sell it for a minimal loss after your done with it.

Al