As Spring approaches – and the warmth will be welcome!, folks start thinking about purchasing an RV camper. Many decide to finance to fund their purchase. Should they? Should YOU? Is it a wise decision?

RV Financing: Some Initial Thoughts

An RV Camper is a DEPRECIATING ASSET. That is, RV’s go down in value, almost ALWAYS from the moment you purchase one. Common wisdom suggests you should never finance something that declines in value unless you really need it.

Few people really NEED an RV camper! But… there are times and cases where buying a camper will enhance the quality of your life and travel. As I noted in a recent post about Purchasing an RV Camper, I can think of three clear cases where it may make sense to go into debt to have an RV camper.

While you can learn more by visiting that post, briefly the three cases are: young families who want to spend quality time and have unique experiences with their kids, older folks who want to travel and experience the RV Lifestyle while they’re still healthy, and professionals who are not tied to a desk and wish to work while traveling. Personally, I enjoy being surrounded by inspiring views while I’m generating posts (articles) like this one for you!

RV’s are considered a LUXURY and the rules for RV loans are a bit different

When I was in RV sales, I had customers approach me about purchasing an RV who expected to qualify for a loan. Their expectation was based upon having carried vehicle and home loans. In many cases, they qualified, but not always.

Cars, trucks and homes are considered to be necessities. RV’s are NOT. As such, you’ll need good credit (700+ credit score) in most cases to qualify (and get a “reasonable” loan rate.) RV loans typically have a term of 10 or more years (some are as long as 20 years!) Recreational loans also come (typically) at a higher interest rate than car, truck or home loans.

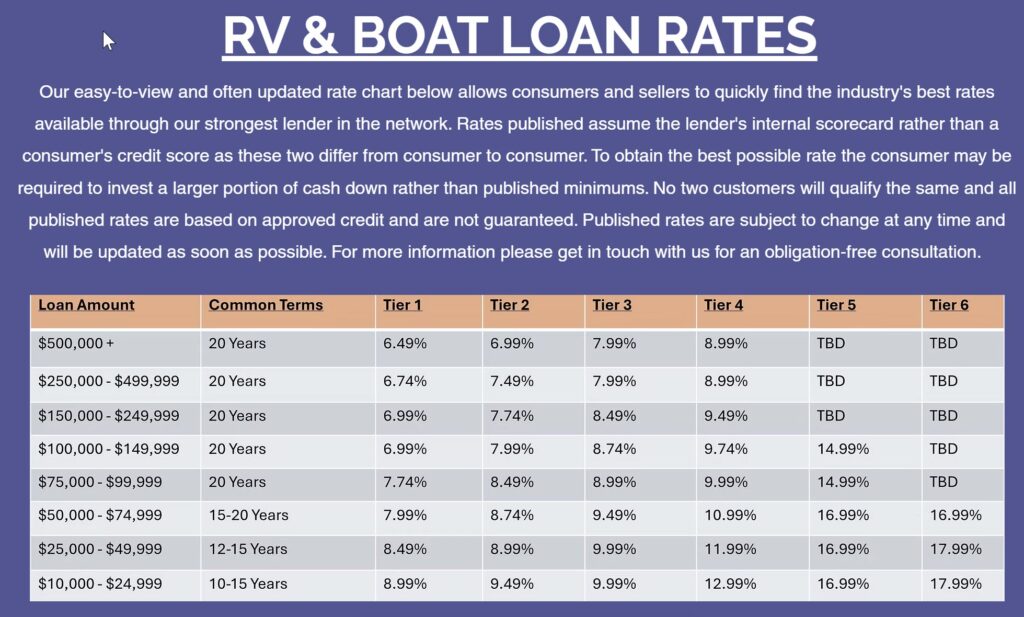

Unless you’re financing well over $100,000. or you have exceptional credit, you’re likely to see rates at 7% or above. According to the chart here, you can see if your credit is anything less than “tier 1” (top credit scores), the rates can be MUCH higher. The chart I linked you to is provided by a company called “Into RV.” I recently learned about him through a YouTube video. I have never used him for any of my Concierge RV Buying Clients to obtain financing so I can’t vouch for him personally. His chart however gives us a good ballpark for what loan rates look like today.

You may be able to deduct the interest accrued on an RV loan. Check with your tax preparer to see if you qualify.

RV Loans – Know what you’re REALLY paying over the life of the loan…

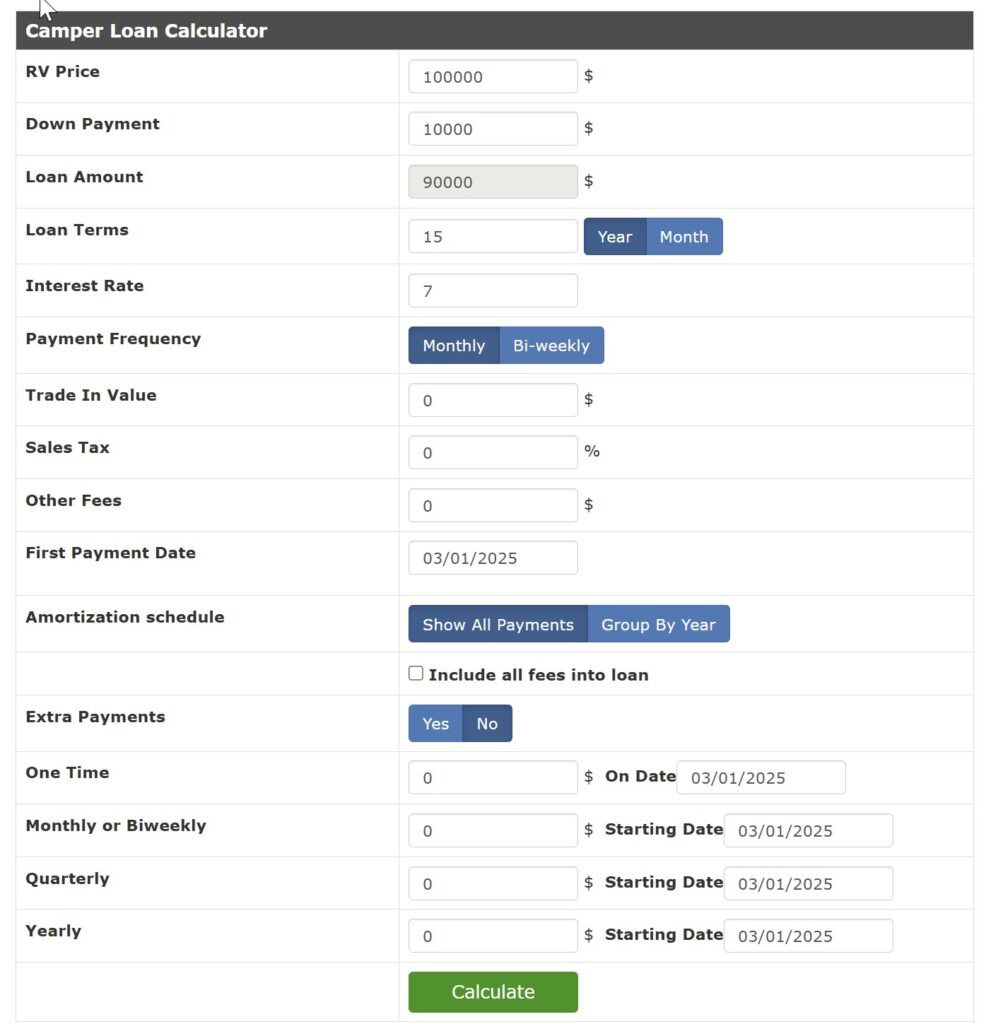

A 7% rate can become a VERY expensive loan! Here’s a scenario that I ran through this rv loan calculator:

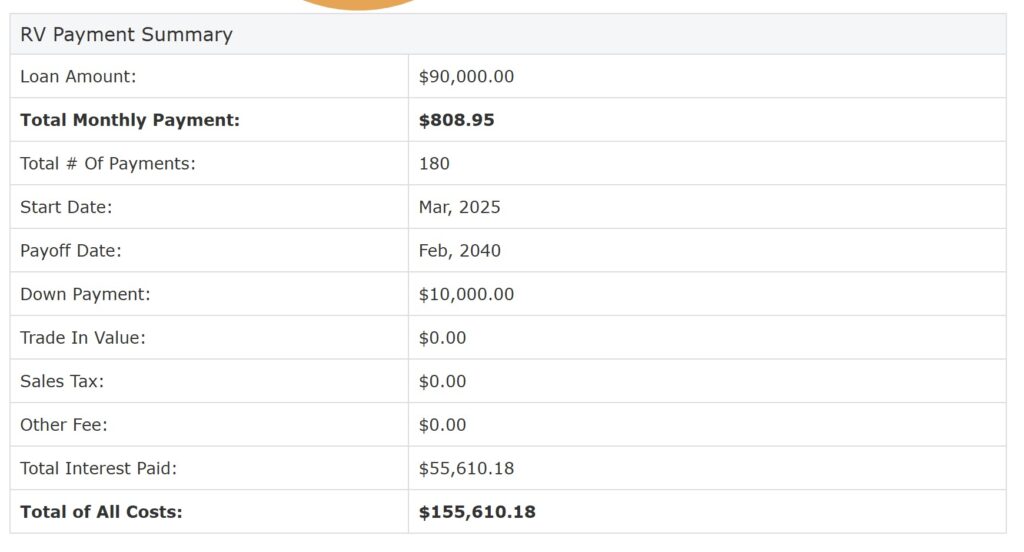

Consider a camper with a total purchase price of $100,000. Let’s imagine you have some funds in the bank, enough to apply a 10% ($10,000.) deposit. You’re effectively borrowing $90,000 and lets say the term is 15 years. Your monthly payment will be $808.95. Remember: a shorter term will bump the monthly payment up to a level that most can not handle.

If you make this payment monthly for the next 15 years, you’ll own a camper worth next to nothing AND have paid a total of $155,610.18 for this camper! In short, a $100,000. camper will cost you over 50% more – and after it all, you’ll own a 15 year old camper for the effort!

Here’s one additional thought… Let’s say you decide to sell it after 3 years of ownership. You’ll still owe the lender over $78,000! In other words, in three years, you’ve only paid down less than $12,000. of the original $90,000. loan. Even IF the camper you purchased was worth $100,000. on your purchase date, it may EASILY be worth $10-20,000. LESS than what you still owe the bank when you TRY to sell your camper!

Here’s one additional thought… IF this buyer opted to put $0. down, the total cost balloons to nearly $162000 and after 3 years, they still owe over $87000!

Needless to say, I spend lots of time working with my Concierge RV Clients to ensure there are NO surprises when financing a camper! Got questions? CALL OR TEXT ME at 307 269 2546 – Mountain Time.

THINK before you sign!!

Especially if you’re attending an RV show and having your arm twisted by a slick RV salesman! Think before you sign any RV loan documents. Even if you think that “dream camper” at the show may be the right one, ask yourself… is there a better price available elsewhere? Are you being offered the best possible loan rate? Not to promote myself, but this is something I protect my Concierge RV Clients from as I review all deals offered.

Don’t get caught “upside down”

RV’s, especially NEW RV campers have a steep depreciation curve. That is, most new RV’s are worth FAR LESS two years after purchase than the original purchase price. RV loans as with other types of loans require you pay interest before principal. Even if you qualify for a zero down payment or a very low down payment, while enticing, realize that a few years after you sign the papers, you will have paid very little towards the principal if you’re making the minimum required payment.

I’ve had many potential clients contact me to sell their campers, only to discover that they owe thousands (or tens of thousands) dollars more than they can expect to receive when selling their camper. This is clearly an undesirable position to be in. With RV loans running (typically) 12-15 years, you may be 3 to 5 years into the loan before you begin to pay down the principal due on your camper.

Used campers typically do not experience such steep depreciation. The key with used campers is to find one that was constructed well to begin with and has been cared for and maintained. When I search for campers for my clients, this is a major focus of my initial interview with the seller.

Additional Costs to owning a camper

It’s not just the initial purchase plus sales tax. You’ll need to consider storage (if you’re not full timing), maintenance, insurance, travel costs, etc. Bear these costs in mind when considering your budget for an RV camper. Note: When it comes to insurance, IF you’re full time, tell them!!

Dealers make profit on the “front end” and the “back end” of an RV purchase – YOU can use this knowledge to your advantage…

The “front end” is the sale price of an RV on which the dealer is making a profit. The “back end” is financing and additional offers (extended service contracts, paint protection, interior protection, etc.) All of which make the dealer additional profit. Incidentally, to MOST “additional offers”, I most often recommend you say “no!”

Since dealers profit when you use dealer offered RV financing, you *may* be able to score a better selling price on the camper. For my clients, I take this on a case by case basis. Finance rates themselves with a dealer may be negotiable.

Final Thoughts

RV Loans aren’t cheap – even if you get “superior” rates. When my clients and I speak, we often discuss what they NEED to spend on a camper in order to get something in good working order and in great condition that will serve their needs.

I recently helped one client acquire a lightly used class C motorhome for just over $40,000. Another purchased a top of the line travel travel trailer, built better than 99% of its competitors in “like new” condition for under $25,000. That camper when new sold for well over $50,000.

Again, want to talk? Check my services here – or text/call me at 307 269 2546.

Got an RV and need GREAT accessories? Check my pages for equipment I personally use and endorse…

Absolutely great article

Thanks for the affirmation Dave!